JANUARY 2026 MARKET ANALYSIS FOR CHICAGO'S NORTH SIDE

Our monthly market analysis details six real estate metrics for the Near North Side, Lincoln Park, Lakeview and North Center, followed by our comprehensive monthly summary. This month we recap 2025 and look ahead to 2026.

Please let us know if you need information on any of Chicago’s other neighborhoods

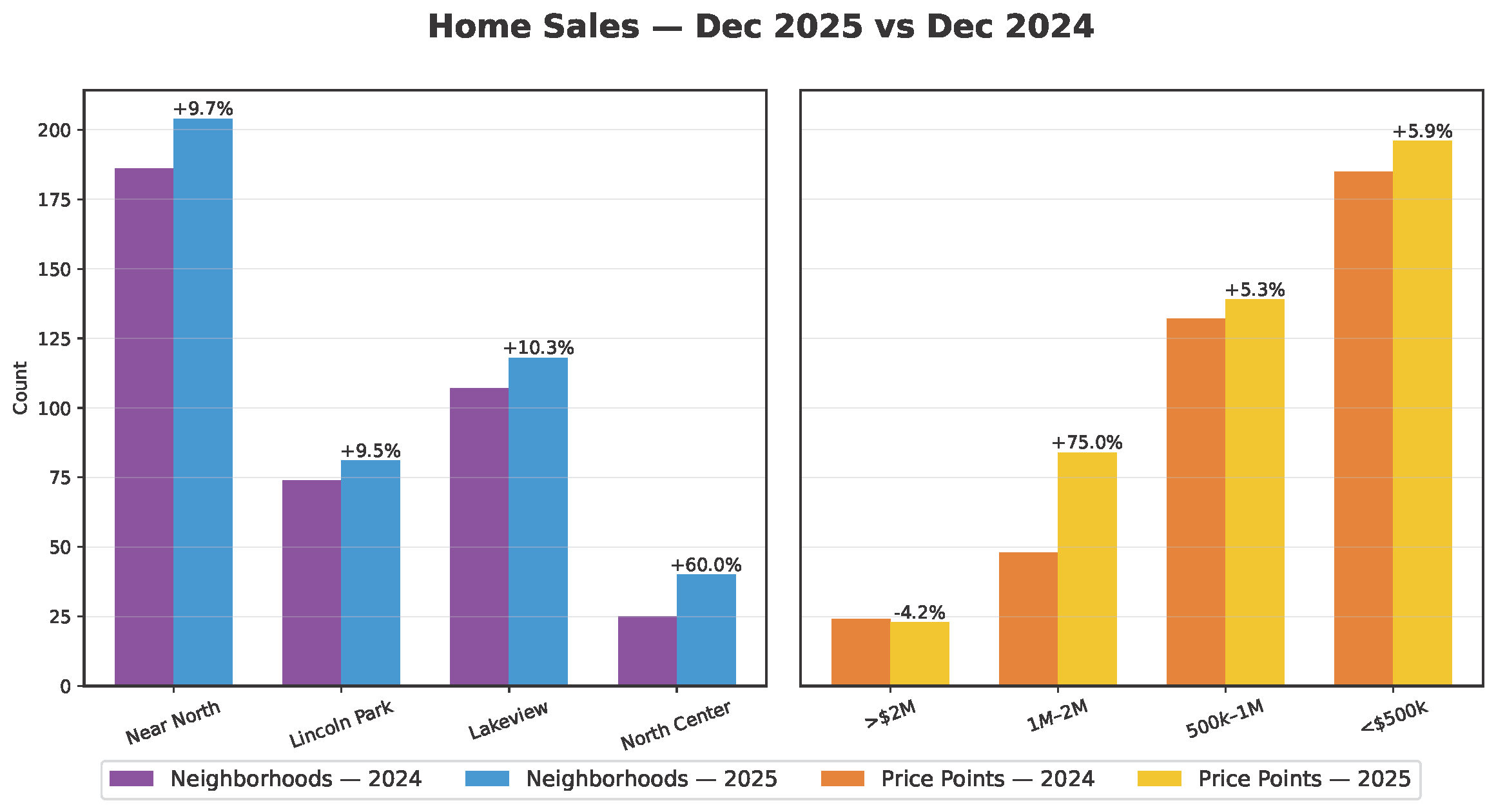

DECEMBER HOME SALES

Year To Date 2025 vs 2024 - Up 4.0%

December 2025 vs 2024 - Up 13.0%

NOTEWORTHY:

2025 ended on a positive note with home sales increasing in December 13% vs 2024. This was fueled by a 60% increase in North Center and a 75% increase in homes priced from $1,000,000 to $2,000,000.

Total 2025 home sales increased 4.0% over 2024

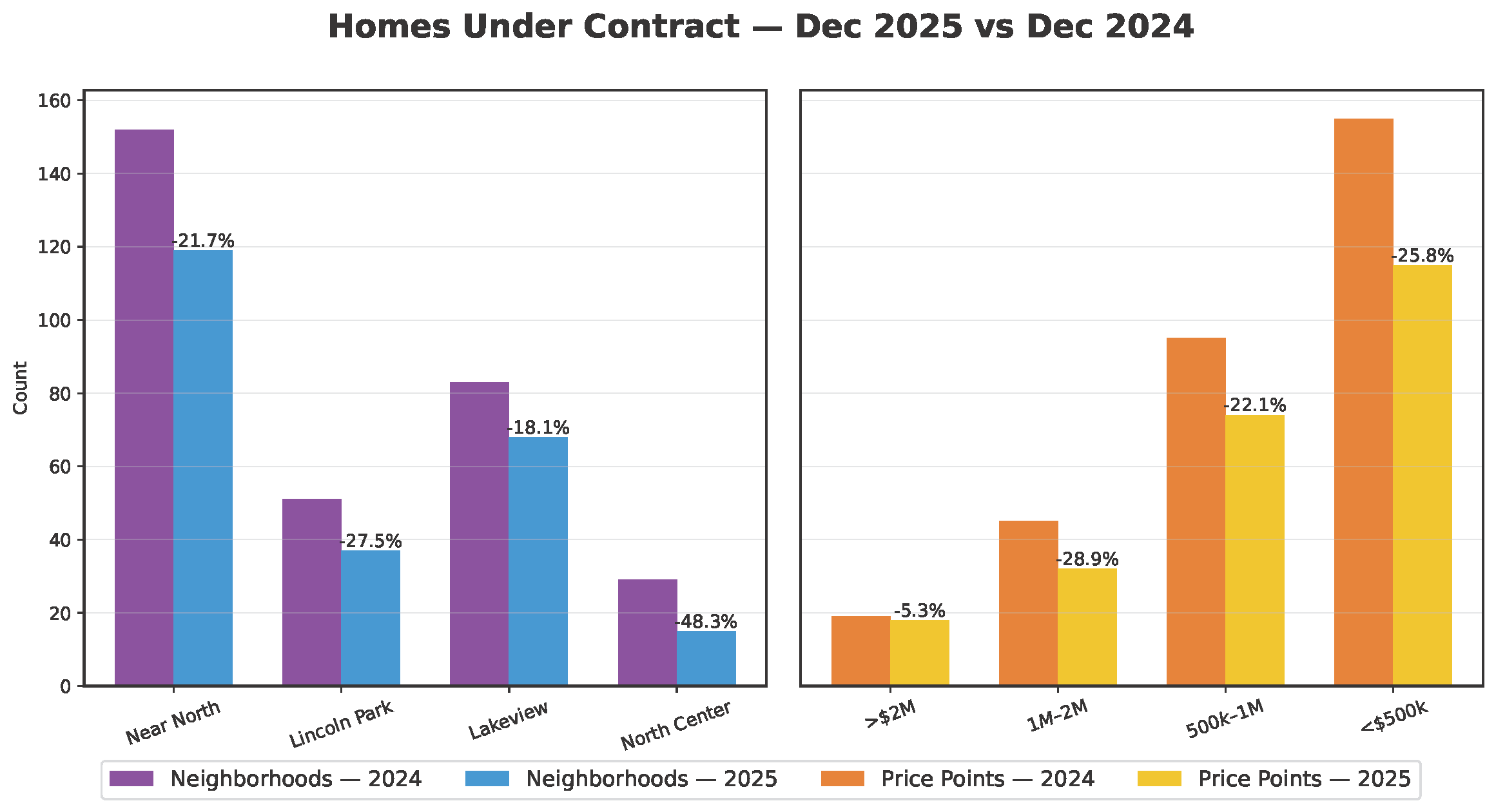

DECEMBER HOMES UNDER CONTRACT

Year To Date 2025 vs 2024 - Up 0.9%

December 2025 vs 2024 - Down 24.1%

Noteworthy :

Most home sales that closed this month went under contract in a previous month. Units Under Contract reflects a more accurate picture of the current month, although not every home that goes under contract closes. The The 24.1 % decrease in December 2025 vs 2024 could be an indicator for January 2026 home sales.

Total homes that went under contract in 2025 increased 0.9% vs 2024

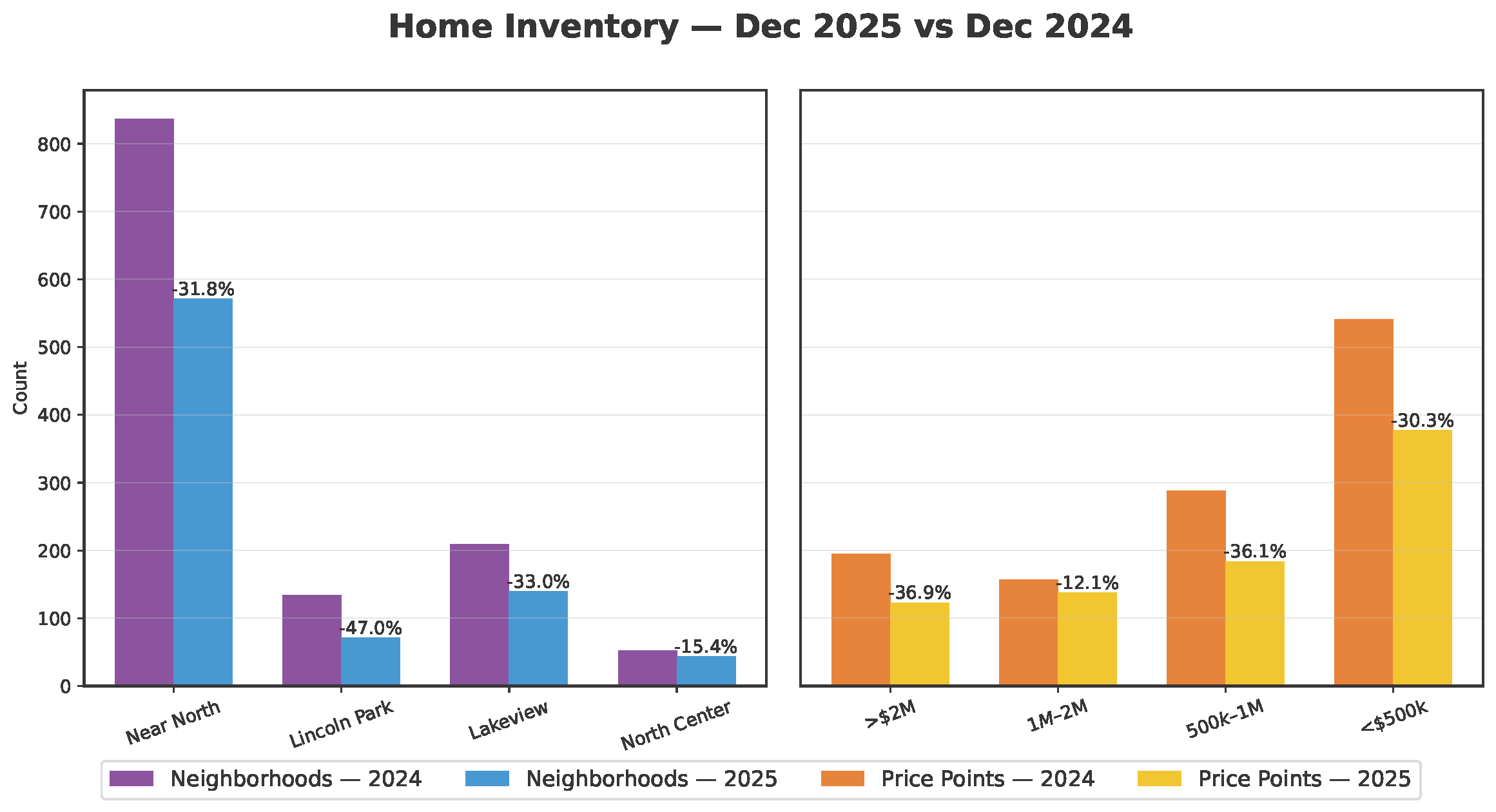

DECEMBER HOMES FOR SALE

Year To Date 2025 vs 2024 - Down 21.6%

December 2025 vs 2024 - Down 32.9%

Noteworthy:

Overall supply dropped 32.9% in December 2025, with double digit decreases in all four neighborhoods.

Total 2025 inventory levels dropped 21.6% vs 2024.

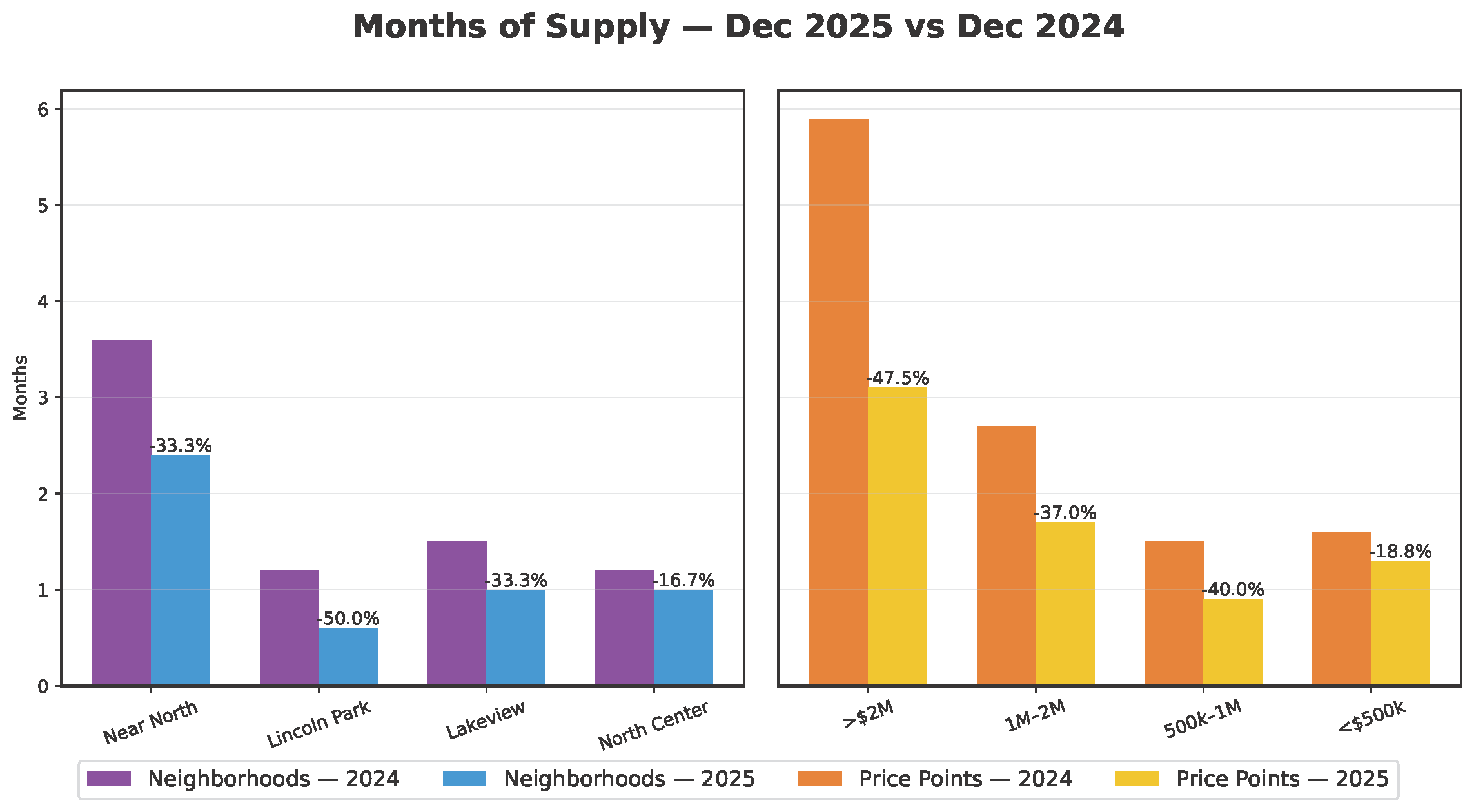

DECEMBER MONTHS OF SUPPLY OF INVENTORY

Year To Date 2025 vs 2024 - Down 22.2% to 2.1 MSI

December 2025 vs 2024 - Down 31.5% to 1.3 MSI

Noteworthy :

December 2025 MSI dropped 31.5% vs 2024 to 1.3 MSI.

Lincoln Park dropped to 0.6 MSI vs 1.2 MSI in 2024 to a record low.

Total 2025 MSI dropped 22.1% vs 2024 to 2. 1 MSI

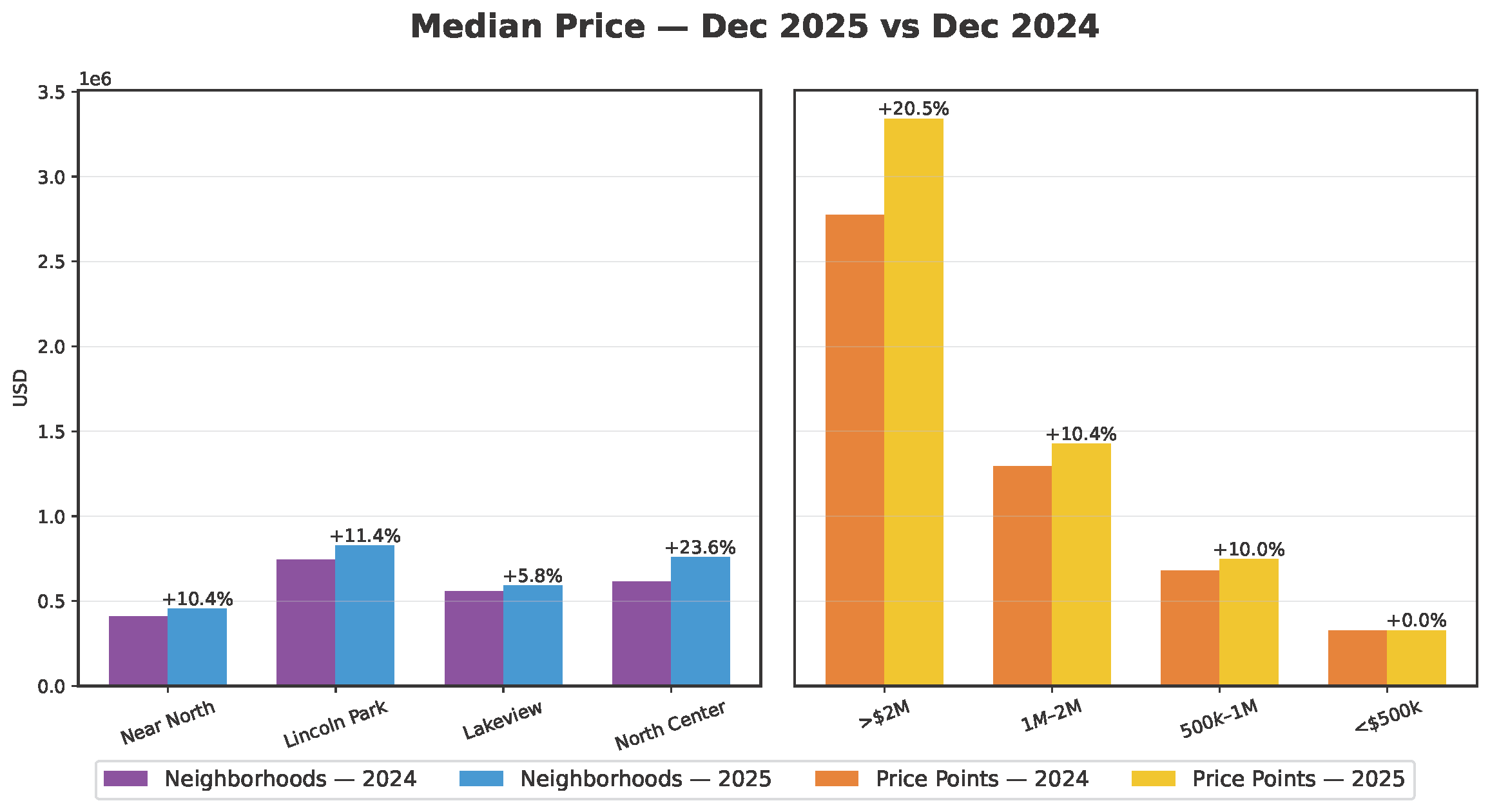

DECEMBER MEDIAN PRICING

Year To Date 2025 vs 2024 - Up 9.4%

December 2025 vs 2024 - Up 13.1%

Noteworthy :

Median Prices rose +13.1% overall in December 2025 vs 2024. North Center posted the strongest gain (+23.6%), while Lakeview saw the smallest gain (+5.8%)

Total 2025 median prices rose 9.4% over 2024

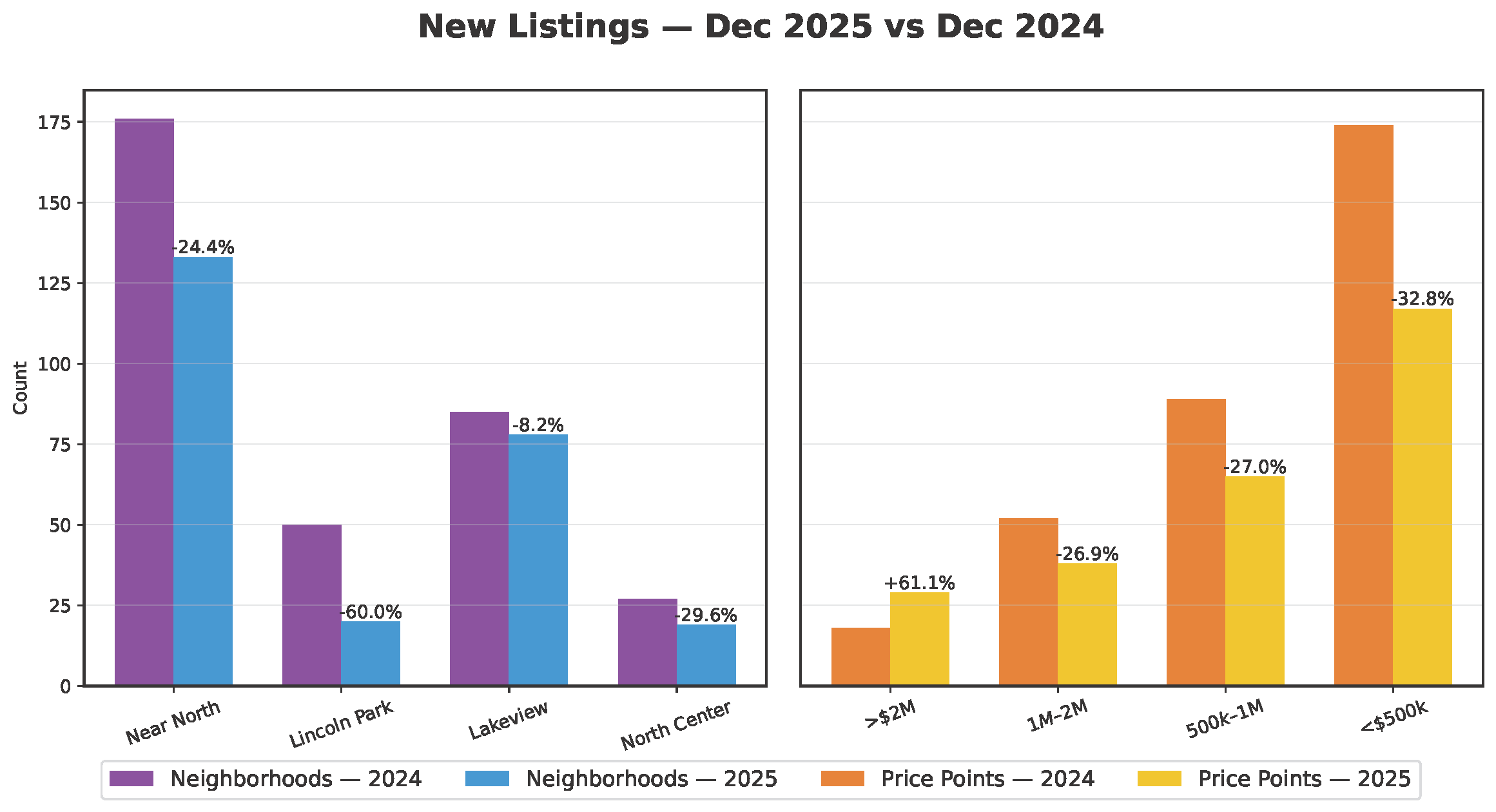

DECEMBER NEW LISTINGS

Year To Date 2025 vs 2024- Down 11.8%

December 2025 vs 2024 - Down 26.0%

Noteworthy :

December 2025 New Listings were down 26.0% overall (250 vs 338).

Total 2025 new listings dropped 11.8% vs 2024

DECEMBER SUMMARY

DECEMBER MARKET INDICATORS

Despite historically low inventory levels, December 2025 home sales rose 13% vs 2024 in the combined neighborhoods of Near North, Lincoln Park, Lakeview and North Center. This resulted in a 4% increase in total 2025 home sales vs 2024.

As we head into a new year and the 2026 real estate season, there are reasons to be optimistic as well as cautious.

Inventory is the “make or break” component to 2026 home sales.

Currently inventory levels are at all time lows and despite a strong pool of buyers, there is not enough supply to meet demand.

Using Lincoln Park as an example:

- 81 homes were sold in December 2025.

- 71 Homes remained for sale at the end of December 2025.

- There were 20 new listings in December 2025.

- The months of supply of inventory is now at a critically low .6 MSI. This is the first time that a North Side neighborhood has had an MSI under 1.0 in recent history.

While Lincoln Park is an extreme example, all four of our neighborhoods are experiencing severe inventory shortages.

The good news is the luxury market on the Chicago’s North Side is doing well. Luxury buyers have more inventory to choose from (3.1 MSI) and are less affected by high interest rates.

Should interest rates continue to fall in 2026, sellers that have been sitting on the sidelines with low interest loans, may decide that the time is right to look for new homes. This will give the market an infusion of inventory that it so desperately needs.

The 2026 real estate market on the North Side should be quite interesting and could make a positive upturn.

Be sure that your broker has experience in navigating what could be a changing and complicated market.

GOING FORWARD

With the current financial issues at the national and local levels, events continue to unfold. This makes it impossible to predict with certainty how our local real estate business will be affected. We will keep you updated.

YOUR HOME

A logical question would be “how does all of this affect the home that I am planning to sell or potentially buy?”

Every home is unique and a detailed analysis of your property and neighborhood is a necessity to fully understand the true market value and whether this is the right time to buy or sell.

There are many criteria both objective and subjective that must be analyzed in order to get a true picture.

Internet home pricing sites that claim to calculate your home’s value using only algorithms can be wildly inaccurate. Many market analysis from real estate agents that have not taken the time to personally tour the home can also be seriously flawed. Today’s volatility demands that you get a broker who thoroughly understands this rapidly changing market.

Whether you are buying or selling a home, we would welcome the opportunity to have a conversation about your real estate needs, goals and expectations.