FEBRUARY 2026 MARKET ANALYSIS FOR CHICAGO'S NORTH SIDE

Our monthly market analysis details six real estate metrics for the Near North Side, Lincoln Park, Lakeview and North Center, followed by our comprehensive monthly summary.

Please let us know if you need information on any of Chicago’s other neighborhoods

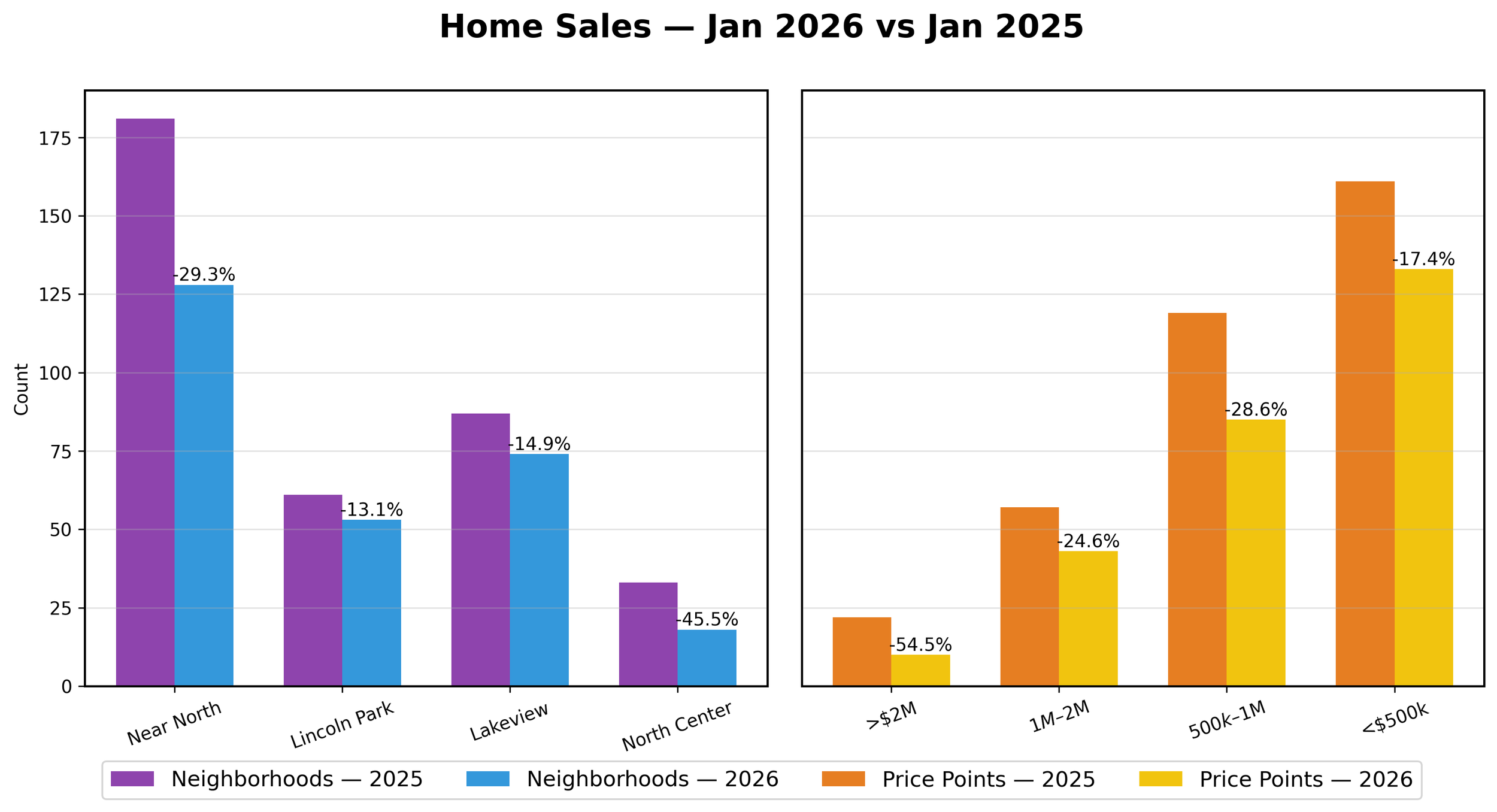

JANUARY HOME SALES

Year To Date 2026 vs 2025 - Down 24.6%

January 2026 vs 2025 - Down 24.6%

NOTEWORTHY:

All four neighborhoods and price points reported double digit decreases.

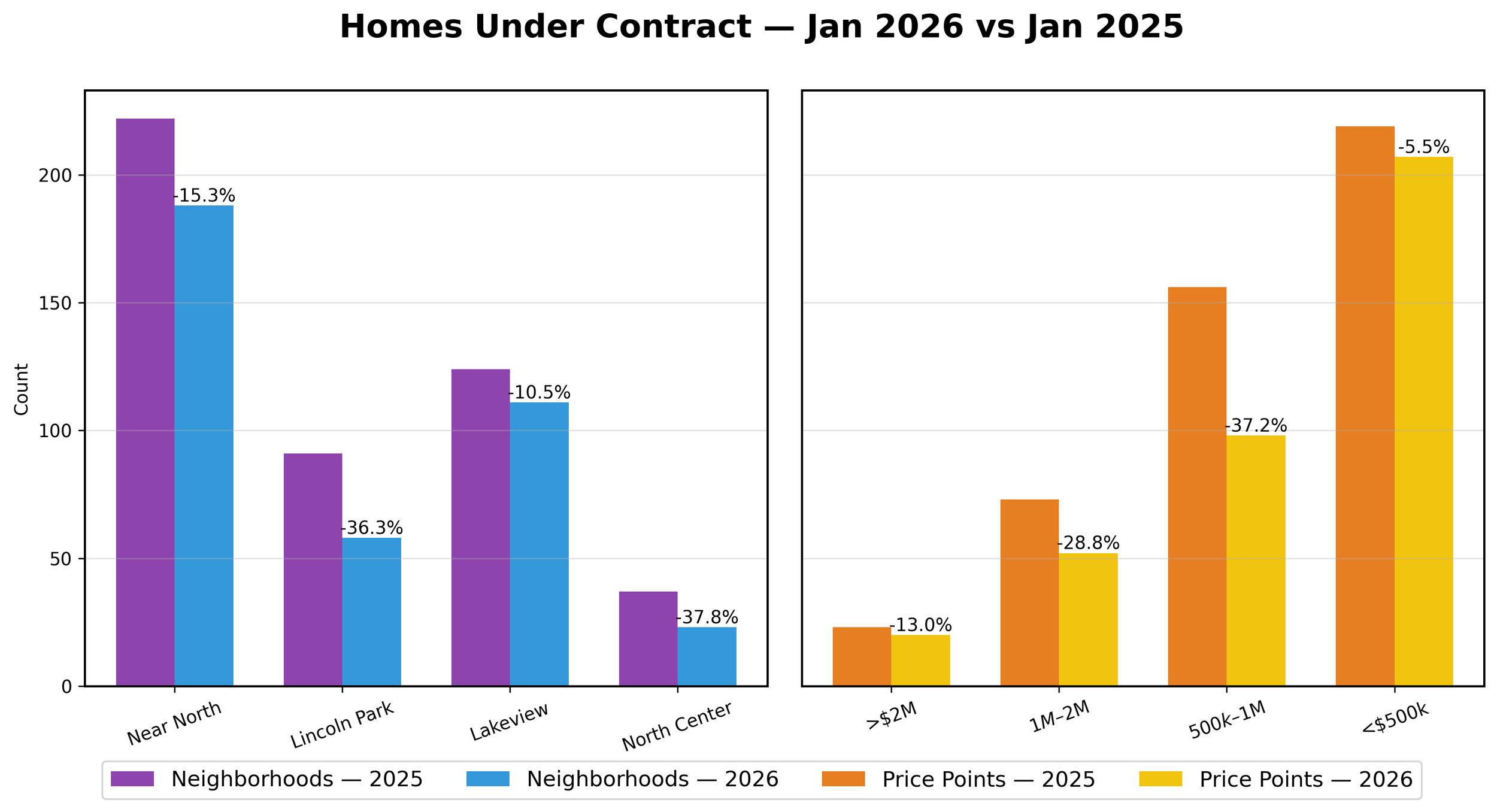

JANUARY HOMES UNDER CONTRACT

Year To Date 2026 vs 2025 - Down 19.8%

January 2026 vs 2025 - Down 19.8%

Noteworthy :

Most home sales that closed this month went under contract in a previous month. Units Under Contract reflects a more accurate picture of the current month, although not every home that goes under contract closes. The The 19.8 % decrease in January 2026 vs 2025 could be an indicator for February 2026 home sales.

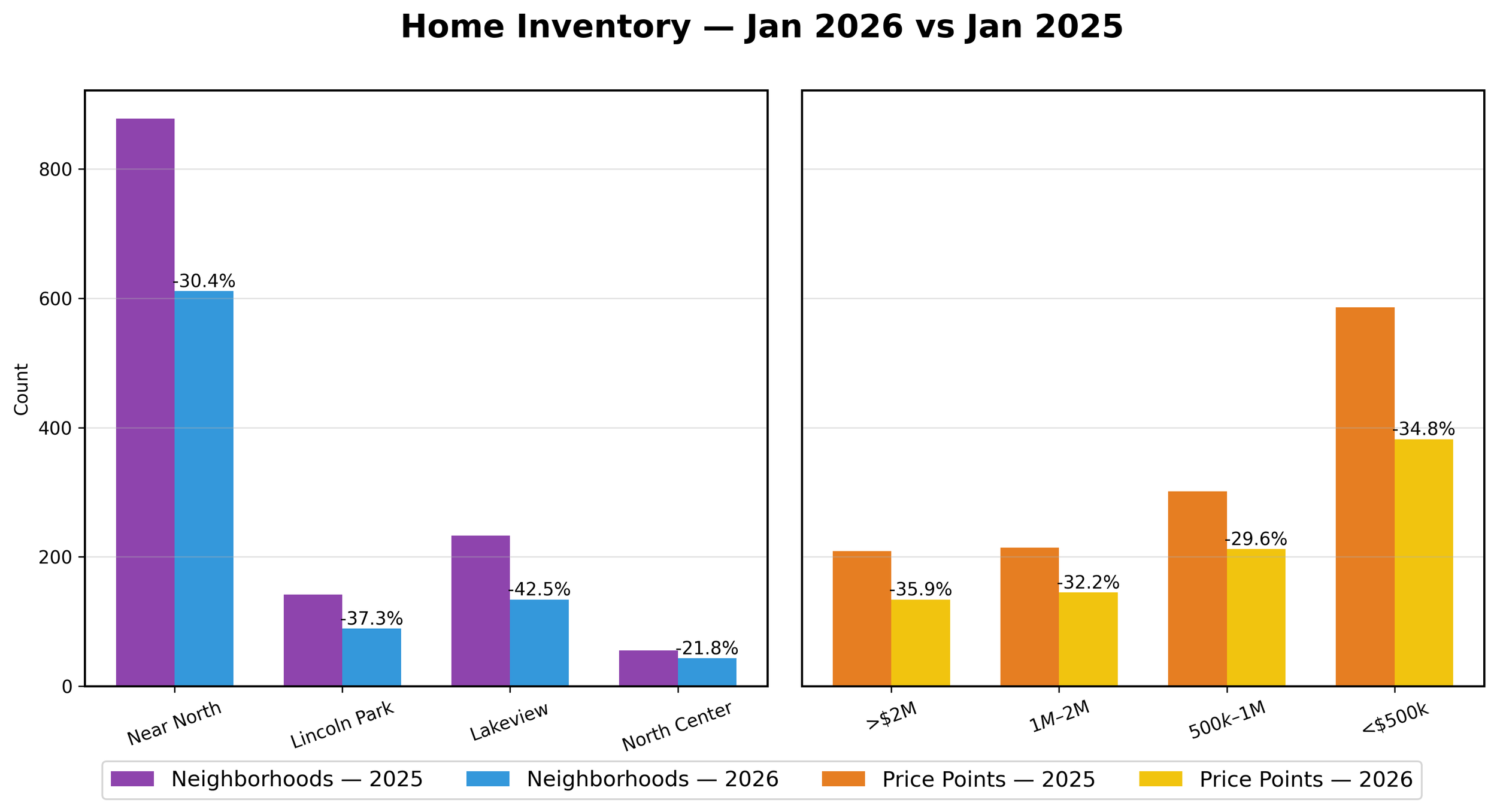

JANUARY HOMES FOR SALE

Year To Date 2026 vs 2025 - Down 33.5%

January 2026 vs 2025 - Down 33.5%

Noteworthy:

Overall supply dropped 35.5% in January 2026, with double digit decreases in all four neighborhoods & price points. These are the lowest inventory levels that we ever experienced.

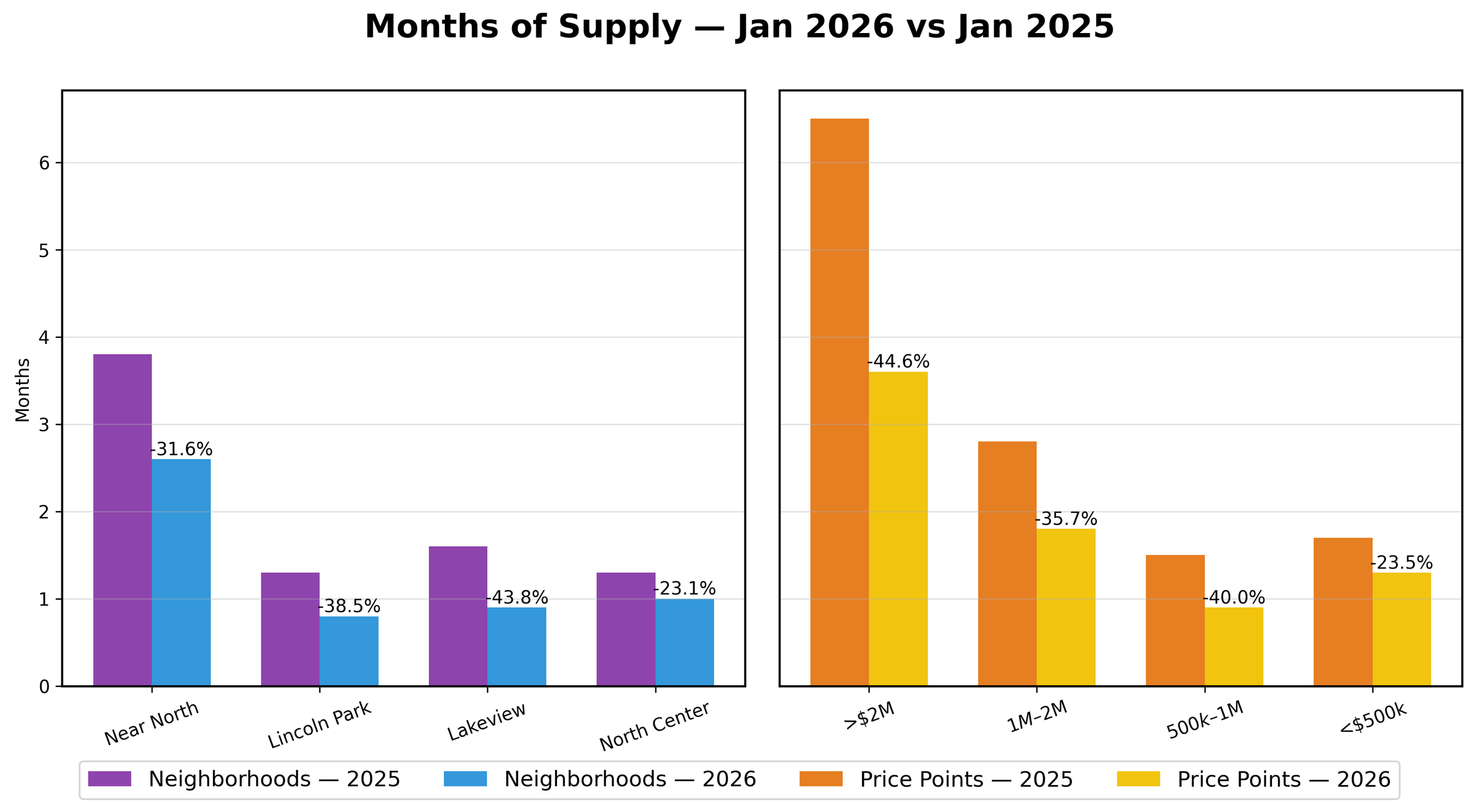

JANUARY MONTHS OF SUPPLY OF INVENTORY

Year To Date 2026 vs 2025 - Down 35.1% to 1,3 MSI

January 2026 vs 2025 - Down 35.1% to 1.3 MSI

Noteworthy :

January 2026 MSI dropped 35.0% vs 2025 to 1.3 MSI.

Lincoln Park, Lakeview and North Center all dropped to under 1.0 MSI for the first time

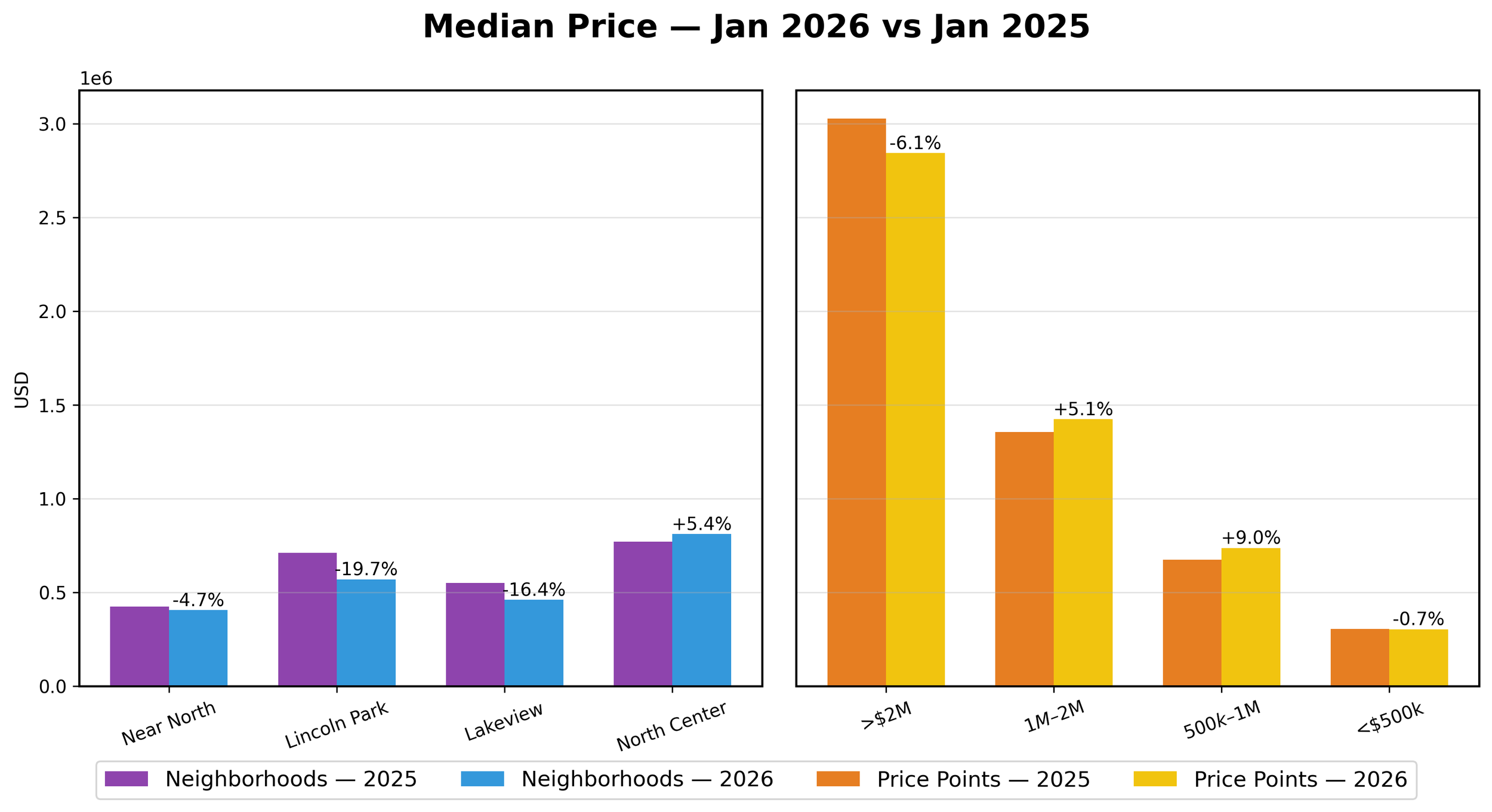

JANUARY MEDIAN PRICING

Year To Date 2026 vs 2025 - Down 8.5%%

January 2026 vs 2025 - Down 8.5%%

Noteworthy :

Median Prices in January 2026 dropped 8.5% vs 2025. This was the first drop in median prices in 12 months

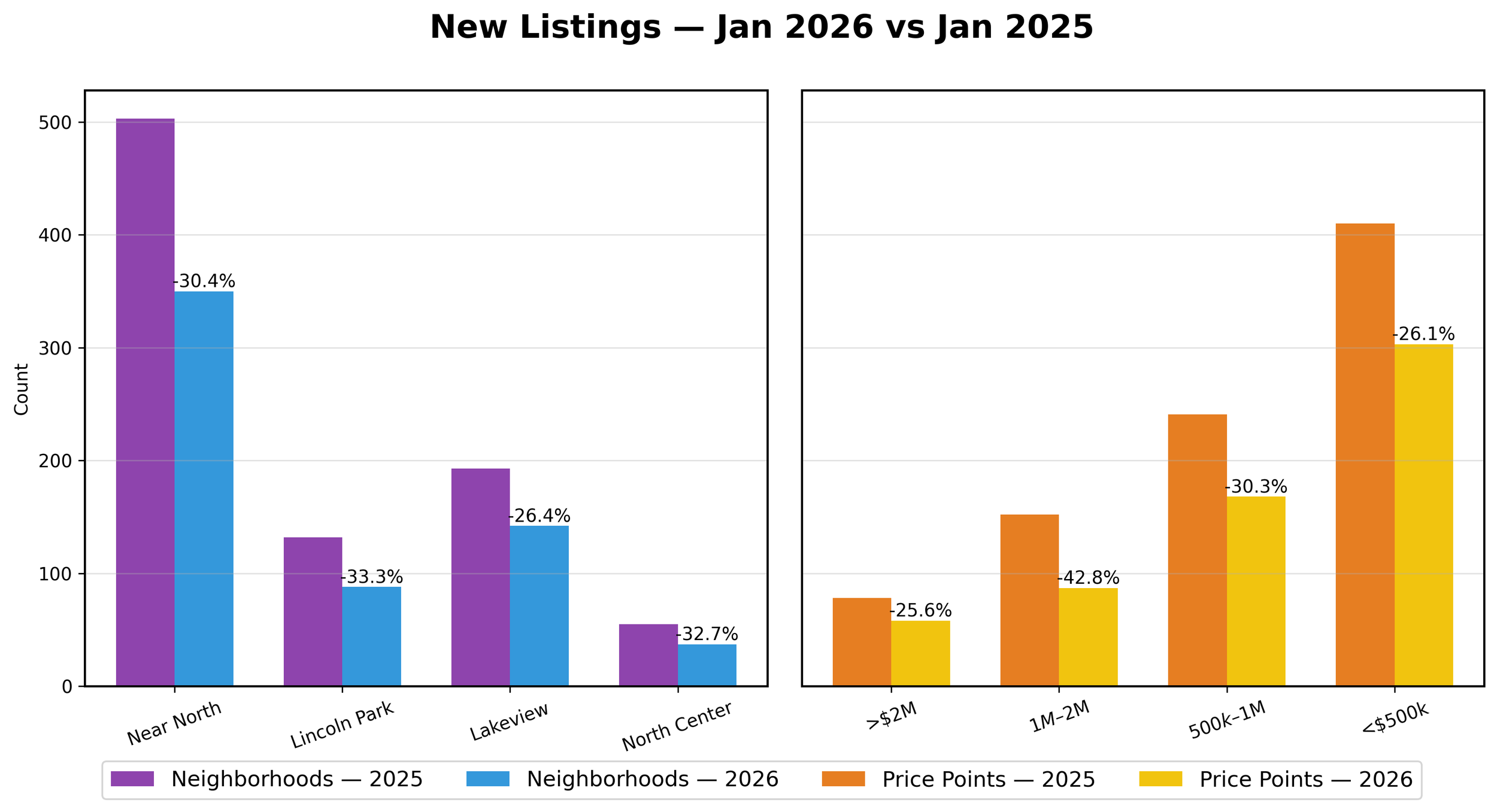

JANUARY NEW LISTINGS

Year To Date 2026 vs 2025- Down 30.1%

January 2026 vs 2025 - Down 30.1%

Noteworthy :

January 2026 New Listings were down 30.1% overall (883 vs 617). Near North accounted for over half of the new listings with 350.

JANUARY SUMMARY

JANUARY MARKET INDICATORS

The historically low inventory levels on Chicago’s North Side took their toll on January 2026 home sales, which fell 24.6% vs 2025. Homes that went under contract in January 2026 also fell 19.8% vs 2025.

January 2026 Inventory levels dropped in all four neighborhoods by 33.5% vs 2025

Months of supply of inventory in January 2026 also fell 35.0% to 1.3 MSI vs 2025. Lincoln Park, Lakeview and North Center dropped to below 1.0 MSI for the first time.

January 2026 new listings dropped 30.1% vs 2025 adding to the inventory woes.

Median home prices which have increased for the past 12 months fell 8.5% in January 2026 vs 2025.

January is traditionally a “ramp up” month for the spring real estate markets and February will give us a better indication of where the 2026 Spring Market is headed.

Our recent open houses confirm that the pool of buyers is still very strong and increasingly attractive interest rates should help this trend.

A significant infusion of inventory is now needed for supply to meet demand. With little new construction in most neighborhoods, this may be a slow but steady clime out of the inventory deficit that we now find ourselves in.

The 2026 real estate market on the North Side should be quite interesting.

Be sure that your broker has experience in navigating what could be a changing and complicated market.

GOING FORWARD

With the current financial issues at the national and local levels, events continue to unfold. This makes it a challenge to predict with certainty how our local real estate will be affected. The single most positive aspect of this market is that there is an abundance of buyers who want to buy and live in our neighborhoods.

We will keep you updated.

YOUR HOME

A logical question would be “how does all of this affect the home that I am planning to sell or potentially buy?”

Every home is unique and a detailed analysis of your property and neighborhood is a necessity to fully understand the true market value and whether this is the right time to buy or sell.

There are many criteria both objective and subjective that must be analyzed in order to get a true picture.

Internet home pricing sites that claim to calculate your home’s value using only algorithms can be wildly inaccurate. Many market analysis from real estate agents that have not taken the time to personally tour the home can also be seriously flawed. Today’s volatility demands that you get a broker who thoroughly understands this rapidly changing market.

Whether you are buying or selling a home, we would welcome the opportunity to have a conversation about your real estate needs, goals and expectations.